Medical offices today are looking for more efficient ways to reduce no-shows and ensure financial stability. One increasingly popular strategy is collecting deposits on appointments. While some offices may be hesitant due to common myths and misconceptions, the benefits can significantly outweigh the concerns.

Incorporating dual pricing into your deposit collection strategy can offer added flexibility and transparency. Dual pricing allows offices to give patients the option to pay either by cash (without additional fees) or by card (with a small service fee). This system can simplify the payment process for both patients and offices, ensuring everyone understands their payment options upfront.

Why Collect Deposits?

Collecting a deposit at the time of scheduling has proven to be an effective way to protect your practice from the costly effects of patient no-shows or last-minute cancellations. Missed appointments can severely affect revenue, disrupt schedules, and create inefficiencies in patient care. Deposits act as a financial commitment from the patient, making them more likely to show up and honor their appointment. With dual pricing, offices can easily manage these payments while offering patients flexibility in how they prefer to pay.

Common Myths About Collecting Deposits

- Myth 1: Patients Will Refuse to Book AppointmentsSome offices worry that collecting a deposit may deter patients from booking appointments, especially if other practices in the area don’t have the same policy. However, when combined with dual pricing, patients feel empowered to choose a payment option that suits their needs—whether paying with cash or opting for card payment with a service fee.

- Myth 2: It Will Lead to Negative Patient ExperiencesThe truth is that clear communication is key. By educating patients on the reasons for the deposit—such as ensuring staff availability and keeping operations smooth—most patients will understand the policy. The dual pricing system helps by providing transparent pricing and clearly showing any service fees upfront, reducing confusion and increasing trust in your office’s payment system.

- Myth 3: It’s Too Difficult to ManageWith modern medical billing software and payment solutions like dual pricing, collecting deposits is streamlined and simple. Dual pricing is integrated into your office’s billing process, ensuring that both cash and card payments can be processed efficiently. Patients have the freedom to choose how they want to pay, and the system automatically calculates any fees associated with card payments.

Benefits of Collecting Deposits with Dual Pricing

- Reduction in No-ShowsAccording to a report from the American Medical Association, patient no-show rates can vary between 5% and 30%, depending on the type of medical office. Collecting deposits drastically reduces this rate, helping ensure that scheduled time is utilized effectively. With dual pricing, patients are even more committed because they are aware of the flexible payment options available when securing their appointment.

- Improved Cash FlowCollecting a deposit at the time of booking can help improve your practice’s cash flow. Even if a patient cancels at the last minute, the office has already recouped some of the costs that would have otherwise been lost. Dual pricing further enhances this by making card transactions seamless, with transparent pricing that clearly communicates to patients if they opt for the convenience of paying by card.

- Streamlined SchedulingWhen patients know they have a financial commitment to their appointment, they are more likely to communicate in advance if they need to cancel or reschedule. This gives your office more time to fill the slot with another patient, minimizing downtime. With dual pricing, patients are more likely to pay deposits early due to the convenience of cashless payments while knowing all fees upfront.

- Enhanced Patient AccountabilityWhen patients have something invested in their appointment, they are more likely to take it seriously. This fosters a sense of responsibility and mutual respect between the office and the patient. Dual pricing’s clear and easy-to-understand pricing options make patients feel more confident in their financial decisions, further increasing their accountability.

Statistics Supporting Deposit Collection

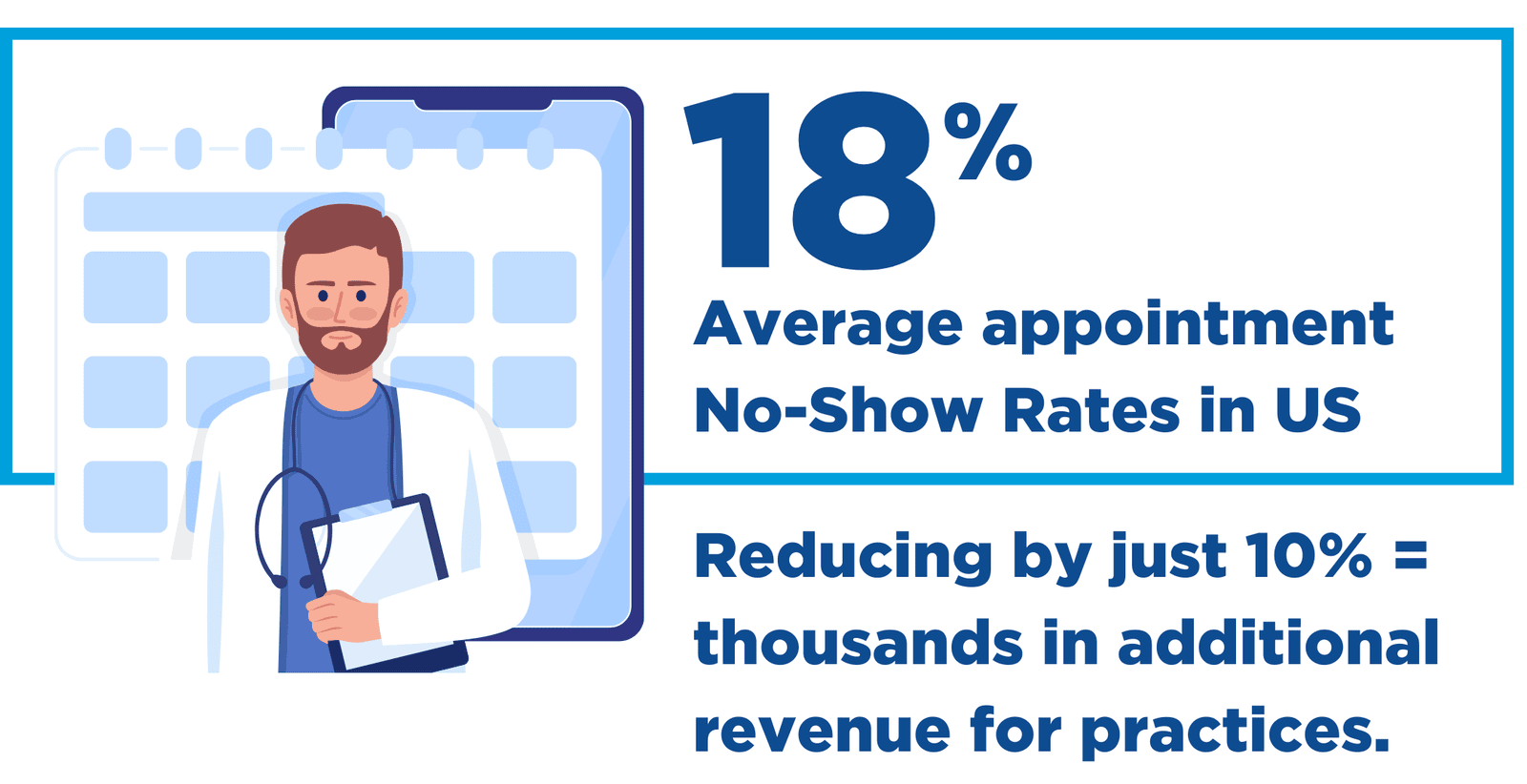

- No-show rates: The National Center for Biotechnology Information (NCBI) reports that the average no-show rate for medical appointments in the U.S. is approximately 18%, leading to billions of dollars in lost revenue annually.

- Revenue Impact: MGMA also found that reducing the no-show rate by just 10% can result in thousands of dollars of additional revenue each year for small to mid-sized practices.

How to Get Started with Appointment Deposits and Dual Pricing

Getting started with collecting deposits and integrating dual pricing doesn’t have to be complicated. Here’s a step-by-step approach:

- Update Your PoliciesBefore implementing deposits, make sure your policies are updated to reflect this new procedure. Additionally, let patients know about dual pricing, which offers them flexibility on how they pay.

- Choose the Right Deposit AmountTypically, deposits range from $25 to $50 for standard appointments or a percentage of the overall treatment cost for more expensive procedures. The amount should be enough to encourage attendance but not so high that it deters bookings. With dual pricing, you can accommodate both cash payments and card transactions, giving patients more control over their financial choices.

- Use Payment TechnologyInvest in a scheduling system that can securely handle payment processing at the time of booking. Dual pricing allows your practice to collect deposits while offering both cash and card options—perfect for ensuring everyone is comfortable with the payment process. Invest in a germ-free experience with contactless payments.

- Communicate ClearlyEducating patients is key. Ensure that your team is trained to explain the deposit policy in a friendly, patient-centric way. Additionally, make sure they can easily explain the benefits of dual pricing so patients know they have payment flexibility.

- Offer Flexible Payment Options with Dual PricingDual pricing empowers patients to choose between paying with cash (no extra fee) or paying by card with a small service fee. This gives patients financial control and allows you to provide a seamless, transparent payment experience.

What Success Looks Like

When medical offices collect deposits, especially with the help of dual pricing, they often see improved patient compliance, reduced no-show rates, and better financial predictability. Success can be measured by fewer last-minute cancellations, increased revenue retention, and an overall smoother operation.

According to a survey by MGMA (Medical Group Management Association), practices that implemented deposit policies saw no-show rates decrease by as much as 50%. Practices using dual pricing for deposits can experience an even greater boost in patient satisfaction due to the flexibility in payment options.

Conclusion

By collecting deposits for appointments and utilizing dual pricing, medical offices can better manage their schedules, improve cash flow, and reduce no-shows. With the right policies and technology in place, including dual pricing, medical offices can offer transparent payment options that cater to patient preferences, creating a win-win for both the practice and its patients.