RESOURCES

The Rules and Regulations of Dual Pricing

Businesses looking for a transparent and legally compliant way to manage credit card processing costs are turning to Dual Price Processing. This model provides customers with clear price options - one for cash and one for card - ensuring compliance with federal, state and card brand regulations.

Dual Pricing vs. Cash Discount: What’s the Difference?

Dual Pricing vs. Cash Discount: What’s the Difference?

While Dual Price Processing and Cash Discounting share similarities, they differ in execution:

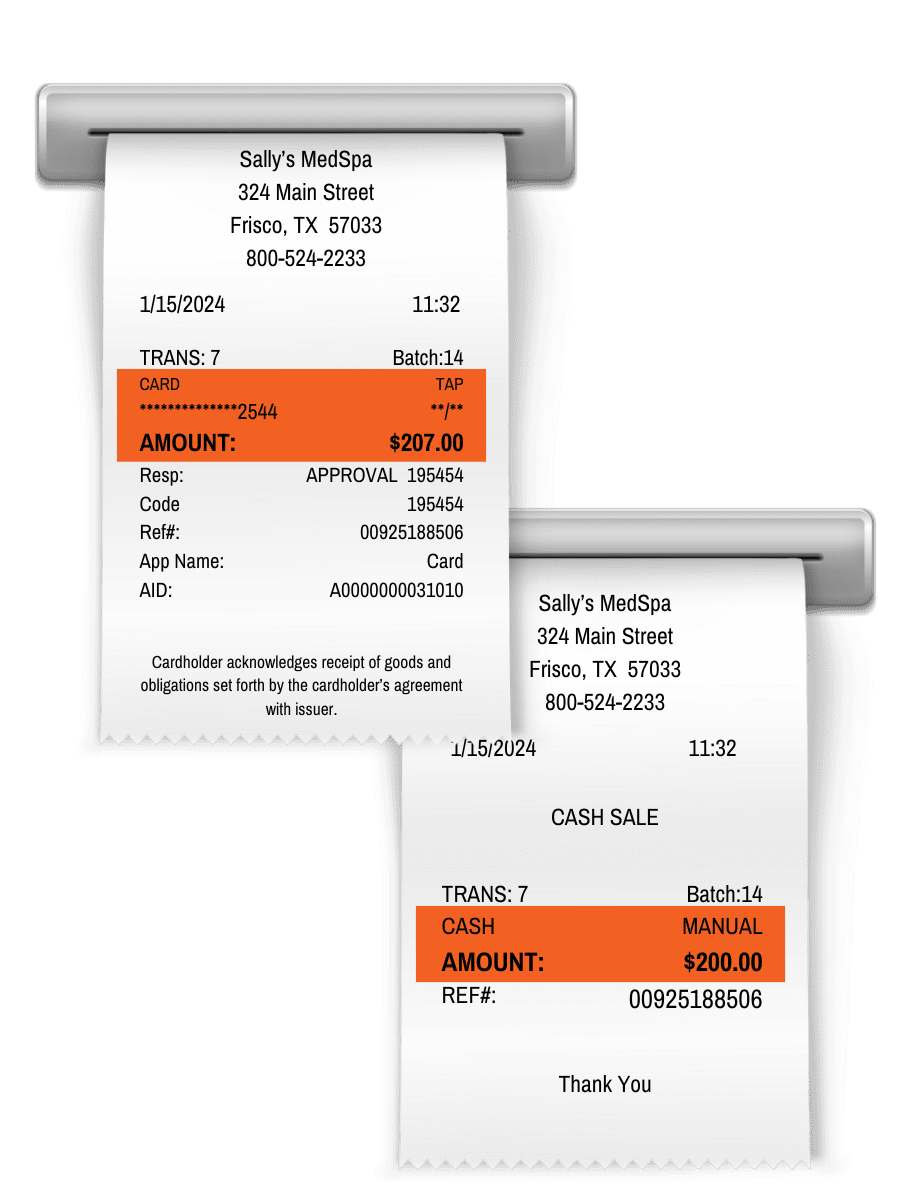

Dual Price Processing: Displays two distinct prices—one for cash, one for card—on menus, price tags, or signage. Customers choose their payment method with full transparency.

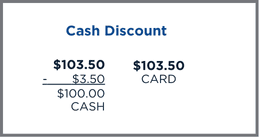

Cash Discount: Provides a discount off the standard price when customers pay with cash. The key legal distinction is that the original price must be the card price, and the discount must be applied before payment.

Many businesses mistakenly structure a Cash Discount program in a way that appears like a surcharge, which can cause compliance issues. With PayLo Pro, we ensure your business follows the correct Dual Pricing model to avoid legal pitfalls.

Dual Pricing vs. Surcharging: Why Dual Pricing is More Widely Accepted

Dual Pricing vs. Surcharging: Why Dual Pricing is More Widely Accepted

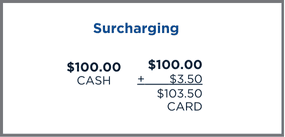

Surcharging adds a fee on top of the advertised price when a customer pays with a credit card. While legal in many states, there are restrictions:

Surcharges cannot exceed 3% or the actual cost of processing.

Visa and Mastercard require merchants to register and follow specific disclosure rules.

Some states, such as Connecticut and Massachusetts, ban surcharges entirely.

Since Dual Price Processing does not add a fee but rather presents two separate prices, it remains compliant in all 50 states. Merchants also avoid the strict card brand regulations that come with surcharging.

Why Choose PayLow Pro for Compliant Dual Price Processing?

Why Choose PayLow Pro for Compliant Dual Price Processing?

At PayLow Pro, we specialize in setting up legally compliant Dual Price Processing solutions for businesses across all industries. Our program includes:

State and federal compliance guidance

Proper signage and receipt formatting to ensure clear price disclosure

Seamless point-of-sale (POS) integration to display both pricing options automatically

Ongoing support to keep your business compliant with evolving regulations

With PayLo Pro, you can maximize profits legally while keeping your customers informed and satisfied.

Starting a Dual Pricing Program?

Starting a Dual Pricing Program?

Give Your Customers Clarity from Day One

Rolling out Dual Pricing is simple—but explaining it clearly is what builds trust.

To help you communicate the change confidently and compliantly, PayLow Pro provides a ready-to-use customer notification letter you can share alongside your in-store signage. This professionally written template explains Dual Pricing in plain language, answers common questions, and reinforces transparency around payment options.

What this letter helps you do:

Clearly explain how Dual Pricing works

Highlight the cash/check discount in a positive, customer-friendly way

Set expectations before the transaction takes place

Reduce confusion and front-desk friction

Reinforce trust and price transparency

Get Started with Dual Price Processing Today

Get Started with Dual Price Processing Today

Don’t leave your payment strategy to chance. Contact PayLow Pro today to ensure your business remains compliant while offering a fair and transparent pricing model. Our experts are ready to help you implement a fully legal, customer-friendly, and revenue-boosting solution.

REQUEST A DEMO

Say hello to your new payment technology partner.