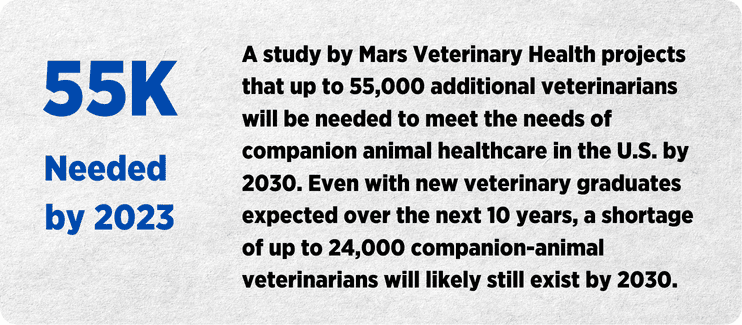

The veterinary industry is facing an unprecedented crisis—a severe shortage of veterinarians. From rural communities struggling to find practitioners to urban clinics experiencing overwhelming caseloads, the demand for veterinary care is outpacing supply. Long hours, emotional stress, and financial challenges are leading to burnout and a decline in professionals entering the field. While solutions like better work-life balance and increased wages are being discussed, there’s another way veterinary practices can improve profitability and sustainability—Dual Pricing.

Understanding the Veterinarian Shortage

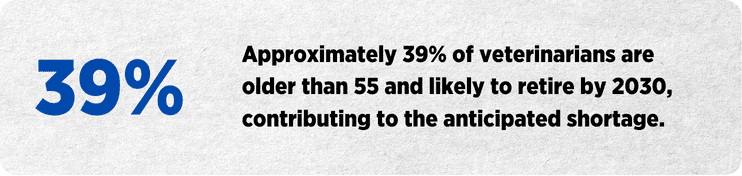

The shortage of veterinarians is driven by several factors, including:

High Levels of Burnout – The emotional toll of euthanasia, difficult diagnoses, and client expectations weigh heavily on veterinarians.

Education Costs & Debt – Veterinary school leaves many professionals with significant student debt, making financial stability a challenge.

Wage Disparities – Compared to other medical professions, veterinary salaries often don’t reflect the rigorous education and workload.

Growing Pet Ownership – More households own pets than ever before, increasing demand for veterinary services without a matching increase in professionals.

With clinics understaffed and struggling to maintain profitability, financial solutions are crucial for keeping practices open and thriving.

How Dual Pricing Supports Veterinary Clinics

Dual Pricing is an innovative payment model that allows businesses to offer two distinct prices: a lower price for customers paying with cash and a slightly higher price for those using credit cards. Here’s how this system can benefit veterinary clinics:

1. Increase Profitability Without Raising Prices

Veterinarians often hesitate to raise service fees due to fear of losing clients. However, processing fees for credit cards eat into already thin margins. Dual Pricing allows clinics to pass these fees to card-paying customers while offering a cash discount, preserving profits without outright increasing service rates.

2. Offset Rising Operational Costs

With labor shortages, clinics often have to pay higher wages to retain staff. Dual Pricing helps offset these increased costs by ensuring that credit card processing fees don’t cut into revenue.

3. Encourage Faster Payments

Late payments and unpaid invoices are common issues for veterinary clinics. Dual Pricing incentivizes pet owners to pay at the time of service using cash, helping clinics maintain better cash flow and avoid chasing down payments.

4. Maintain Affordability for Clients

Pet owners appreciate options, and Dual Pricing provides them with a choice—save money by paying in cash or use credit for convenience. This approach keeps services affordable while covering the costs of payment processing.

5. Invest in Better Equipment and Staff

By reducing credit card fees, clinics can redirect those savings into improving their practice—whether it’s investing in better medical equipment, expanding facilities, or offering competitive wages to attract and retain skilled veterinarians.

Dual Pricing: A Sustainable Solution

In the face of the veterinary shortage, financial efficiency is more critical than ever. By implementing Dual Pricing, clinics can stabilize revenue, keep service costs reasonable for clients, and create a more sustainable business model. Veterinary practices that take control of their financial health will be better positioned to serve their communities and address the growing demand for pet care.

Ready to Learn More? If you’re a veterinary practice looking for ways to navigate the current challenges, PayLo Pro’s Dual Pricing solution can help. Contact us today to see how we can support your clinic’s financial success while keeping pet care accessible for your clients.