How Dual Pricing is Revolutionizing the Dental Industry

THE PAYMENT STATUS QUO

Over the past ten years, credit card expenditures have tripled, resulting in billions of dollars in processing fees for merchants. Despite the lucrative nature of processing, only a minority comprehends the intricacies of this largely unregulated industry.

Dental offices encounter additional challenges compared to regular merchants, such as the elevated expenses associated with accepting virtual credit card payments through their Practice Management System, difficulties in software integration, and the responsibility of handling sensitive patient data. These factors make them particularly susceptible to heightened fees. which add up to thousands in lost profits every year.

Dental Practice Processing Fee Breakdown

Interchange Fees - 1.5%-3.3%

The interchange fee is a payment made directly to the card issuer for the swiped transaction. Fees may vary based on the type of card being used, the amount of the transaction and the industry the business is in.

Card Brand Fees

Assessment fees are fees paid directly to the credit card network so that the merchant can use certain credit cards. This fee is based on monthly sales, not per transaction.

Payment Processor Fees: Base Cost +.14-.40%

The merchant services processor, also called a payment processor, can also charge a fee to facilitate the transaction. Merchant services fees include monthly fees, per-transaction fees, equipment lease fees and statement fees.

Patient Management Software Fee - Monthly Software Fee + 1-2%

All PMS system providers work with third party credit card processors. Because they are already integrated, the processing services can can charge 1-2% more for transactions than stand alone processing.

Why Cash Discount and Surcharging Don't Work for Dental Practices

Cash discounts and Surcharging never really caught on with dental practices for several reasons:

- It’s Confusing: With the addition of a surcharge or subtraction of a cash discount, the pricing display was confusing for patients and became a focal point for dispute.

- No PMS Integration: Running a cash discount or surcharge program separate from a PMS is cumbersome and eats into operational efficiency.

- Doesn’t Cover All Payment Types: HSA/FSA Cards are not accepted with these programs, and Practices pay fees on anything they charge.

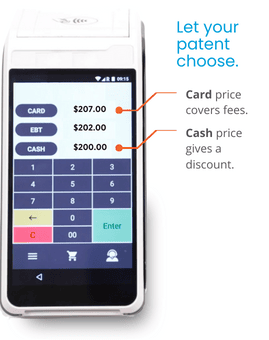

Dual Pricing evolved from the necessity of a cleaner, easier way to pass processing fees to the consumer. Instead of displaying discounts and additions at checkout, there is simply two different price options displayed - one for cash and one slightly higher for credit card. This methodology has seen a much higher adoption rate in the medical industry, with less consumer contention.

Several factors contribute to it’s popularity:

- Easy to understand, professional display to patients

- Clear receipts on checkout

- Accepts HSA/FSA credit cards*

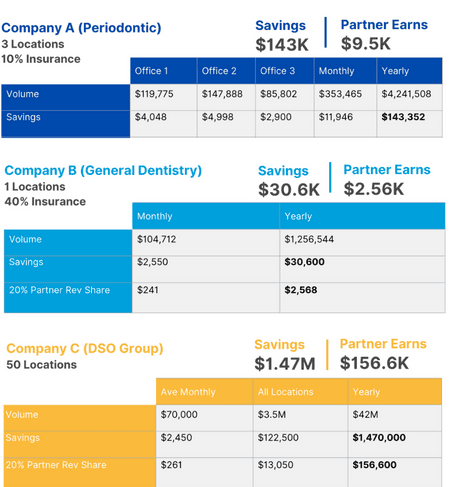

PayLo Pro - Fine Tuned for the Dental Industry

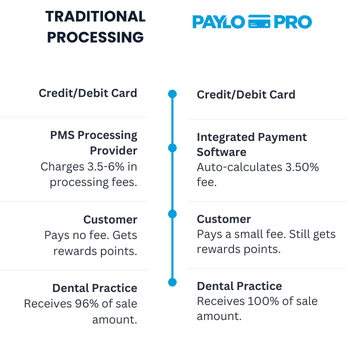

Some processors have elevated these features to the next level. PayLo Pro, for instance, has crafted complimentary seamless integrations with major medical Practice Management System (PMS) platforms like Dentrix. This liberation frees practices from incurring up to 2% higher interchange rates with their PMS provider.

Moreover, PayLo Pro furnishes PCI DDS compliant processing equipment and offers complimentary in-person installation. To ensure effective patient communication, PayLo Pro conducts lunch-and-learn sessions for staff to adeptly handle queries at checkout and navigate dual pricing in patient treatment plans.

Given that 98% of dental practices adhere to the dual pricing model, PayLo Pro stands out by not imposing contracts or obligations, allowing practices to revert to traditional processing at any time. They go a step further by offering to buy out any existing processor contracts.

CASE STUDY: Central Washington Oral & Facial Surgery Center

The center was facing high credit card processing fees and complicated payments software. With PayLo Pro's Dual pricing pay structure and simplified integrations they are now able to save over $8,000 per month in processing fees. Read More.