How to Help Clients Understand Their Coverage Choices — and Make Informed Decisions

Pet insurance is becoming one of the most common questions veterinary offices hear from pet parents — and the demand is only increasing. With rising treatment costs, more complex care options, and families treating pets as true members of the household, clients want guidance. And often, they turn to your team first.

As a veterinary office manager, you play a central role in helping clients navigate these conversations, understand their options, and choose plans that fit their pets’ needs. This guide breaks down the core types of pet insurance, what to look for in a plan, and how your front desk and technicians can confidently explain the differences.

Why Pet Insurance Matters More Than Ever

Veterinary care is advancing quickly — better diagnostics, better treatments, and better outcomes. But with these advancements come higher costs. Even a straightforward emergency can run $1,000–$3,000. More complex cases can exceed $10,000.

Pet insurance:

Helps families say “yes” to care faster

Reduces financial stress during emergencies

Improves compliance with recommended treatment

Builds long-term trust between the clinic and client

Helping clients understand their options isn’t just good customer service — it leads to healthier pets and smoother clinic operations.

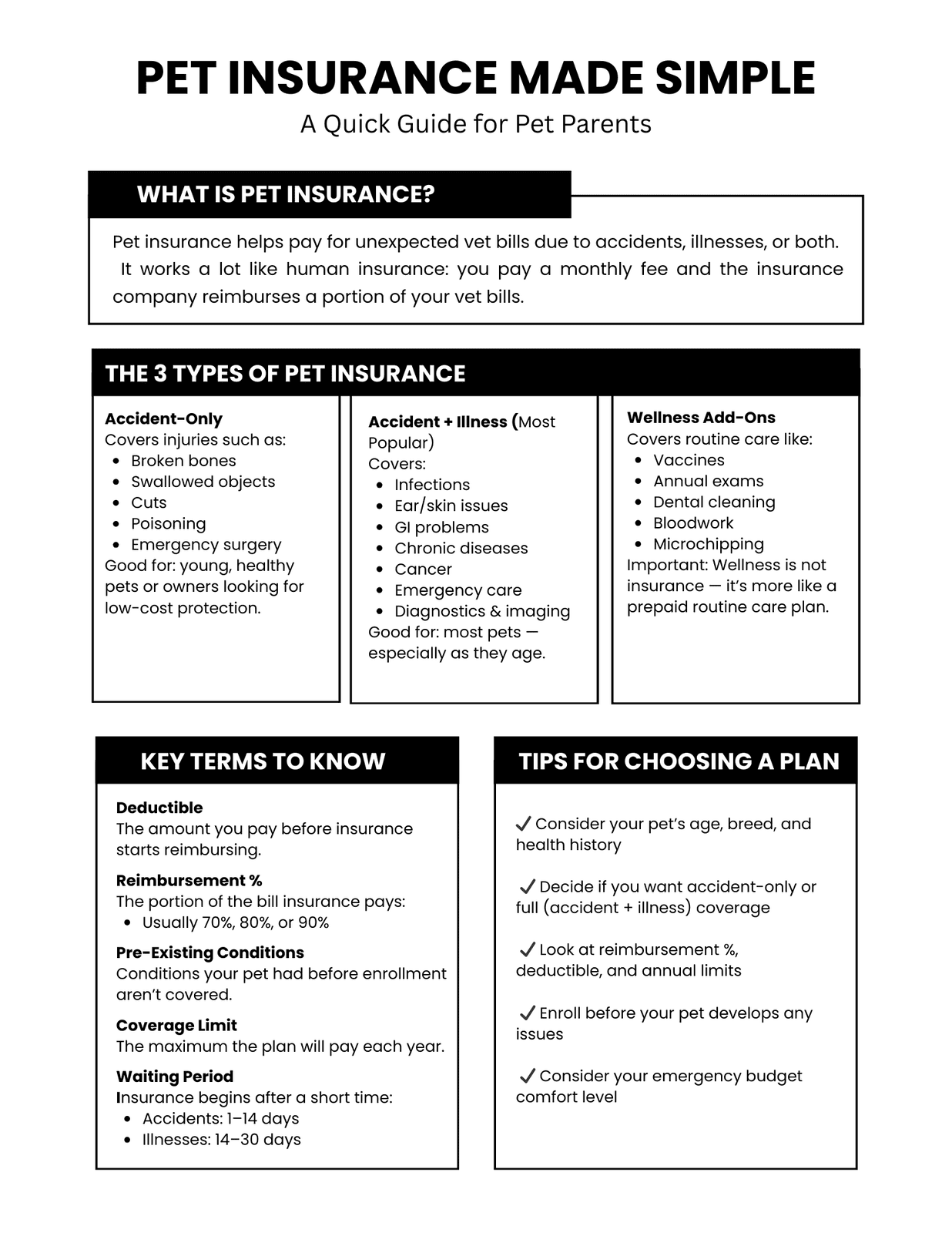

1. The Three Main Types of Pet Insurance

Every plan fits into one of these categories. Knowing the difference helps your team quickly guide clients toward the right conversation.

A. Accident-Only Plans

What they cover:

Injuries, broken bones, poisoning, swallowed objects, cuts, emergency surgery.

Best for:

Young, healthy pets or owners on a budget looking for catastrophic protection.

What to explain to clients:

These plans do not cover illnesses — only injuries.

Great for unpredictable, major emergencies.

Lower monthly premiums, but more limited coverage.

B. Accident & Illness Plans (Most Common)

What they cover:

Illnesses, infections, chronic diseases, cancer, diagnostics, surgeries, emergency care, hereditary conditions (varies by plan).

Best for:

Most pet owners — especially as pets age.

What to explain to clients:

This is the most comprehensive everyday coverage.

Helps with common issues like skin infections, GI illness, ear infections, urinary issues, dental problems, and more.

Coverage varies greatly by provider — some include hereditary conditions, others exclude them.

C. Plans with Wellness / Preventive Add-Ons

What they cover:

Vaccines, annual exams, spay/neuter, dental cleaning, microchipping, flea/tick prevention, heartworm testing, routine bloodwork.

Best for:

Pet owners who want predictable annual costs.

What to explain:

These are not insurance — they're prepaid wellness benefits.

They help smooth out yearly costs and encourage preventive care.

Usually added on top of an Accident & Illness plan.

2. Key Factors to Compare — What Your Staff Should Know

When clients ask “Which insurance should I get?” they’re really asking what matters most. These are the terms to explain clearly:

A. Deductible (Annual vs. Per-Condition)

Annual deductible: pay once per year. Easier for pets with multiple health issues.

Per-condition deductible: pay once for each new condition. Good for chronic conditions but harder to explain.

How to explain to clients:

“Your deductible is what you pay before insurance starts helping.”

B. Reimbursement Percentage

Common options: 70%, 80%, or 90%

Simple explanation:

“If the bill is $1,000 and you have 80% reimbursement, insurance pays $800 after your deductible.”

C. Annual or Lifetime Coverage Caps

Some plans offer no limits. Others cap at $5,000, $10,000, or have per-incident limits.

Help clients think about:

Older pets

Breeds with known health risks

Chronic conditions (diabetes, allergies, hip dysplasia, heart issues)

D. Waiting Periods

Most plans have:

Accident waiting period: 1–14 days

Illness waiting period: 14–30 days

Orthopedic conditions: sometimes 6–12 months

Advise clients:

“Get insurance before your pet develops symptoms.”

E. Pre-Existing Conditions

Every provider handles this differently, but the general rule is:

Pet insurance never covers conditions that existed before enrollment.

This is the #1 point clients misunderstand.

3. Comparing the Most Common Insurance Providers

Here’s an easy breakdown you can use at the front desk when clients ask:

| Provider | Strengths | Considerations |

|---|---|---|

| Trupanion | Pays vets directly, no payout caps, strong illness & hereditary coverage | Higher monthly cost, per-condition deductible |

| Lemonade | Affordable, modern tech, flexible plans | Longer orthopedic waiting periods, reimbursement requires filing claims |

| Healthy Paws | Unlimited annual coverage, strong illness coverage | Age/breed restrictions on hereditary conditions |

| Pets Best | Good value, customizable, strong customer satisfaction | Coverage varies by plan tier |

| AKC Insurance | Very customizable, optional wellness, some pre-existing coverage after waiting periods | Lower-tier plans limited; pre-existing coverage requires long waiting period |

| Fetch | Affordable with flexible deductibles & reimbursement | Lower annual limits on some plans |

For your clinic, this comparison helps staff stay neutral and informative without making specific product endorsements.

4. How to Talk to Pet Parents About Insurance

Your team doesn't need to sell plans — just guide conversations. Here are simple, clinic-friendly talking points.

A. Start with three quick questions

“Do you want protection for accidents only, or accidents and illnesses?”

“Do you want help with routine care like vaccines and checkups?”

“What’s more important: lower monthly cost or more complete coverage?”

These questions help clients reach their own conclusion.

B. Be transparent about limitations

Clients appreciate honesty about:

Pre-existing condition exclusions

Waiting periods

Differences between wellness and insurance

How reimbursement works

When office managers explain this clearly, clients make better decisions — and have fewer billing frustrations later.

C. Encourage early enrollment

The best time to get pet insurance is:

When the pet is young

Before known hereditary risks appear

Before any symptoms start

Explain:

“Insurance works best when your pet is healthy because it covers future issues — not existing ones.”

5. How Pet Insurance Helps Your Clinic Operations

Pet insurance improves:

Treatment approval rates

Compliance with diagnostics and recommended care

Client satisfaction

Cash flow stability

Emergency decision-making

Your practice benefits when clients can say “yes” faster.

6. Where PayLow Pro Supports Veterinary Offices

While PayLow Pro focuses on dual pricing, transparent checkout, and secure payment technology for animal hospitals, we also help practices streamline operations by:

Making treatment costs clearer and easier to explain

Offering modern payment tools that complement insurance reimbursements

Reducing staff time spent on billing conversations

Improving the overall financial experience for pet parents

When clients understand their insurance and have easy payment options, your clinic runs smoother.

Final Takeaway for Veterinary Offices

You don’t need to recommend a specific insurer — but you can make a huge impact by helping clients understand:

The three types of coverage

The key cost variables

What to expect from deductibles and reimbursements

Why early enrollment matters

Differences between major providers

How insurance works alongside payment tools like PayLow Pro

Educated pet owners make confident decisions — and confident decisions lead to healthier pets and healthier practices.

PayLow Pro is here to help you build that system for 2026 and beyond.