There’s nothing wrong with relying on a trusty credit card terminal—until it starts holding your business back.

Whether you're running a boutique, auto shop, dental office, or restaurant, your payment technology should support how your business operates today—not just how it operated five years ago. Many business owners stick with old terminals simply because they still “work.” But in the rapidly evolving world of commerce, working and working well are two very different things.

If you’re still using a basic, standalone terminal that plugs into your countertop and only processes payments, it may be time to take a closer look at what you’re missing.

1. You’re Stuck Behind the Counter When You Need to Be Mobile

Real-world examples:

A contractor finishing a kitchen remodel has to text the client an invoice and wait days for payment instead of collecting right then and there.

A coffee trailer at a festival misses out on sales because their wired terminal can’t connect reliably outdoors.

A business owner at a pop-up market wants to offer card payments but has no access to Wi-Fi or electricity.

What today’s tools can offer:

Mobile payment solutions like wireless terminals or Tap to Pay on iPhone allow you to take payments anywhere—using 4G, Wi-Fi, or Bluetooth. Systems like the Valor RCKT or SwipeSimple’s B250 reader pair with mobile devices, turning your smartphone or tablet into a secure, card-accepting machine. Some models, like the Dejavoo QD2, offer an all-in-one Android touchscreen experience with digital receipts, tipping prompts, and customer-facing displays.2. You’re Wasting Time on Manual Tracking, Spreadsheets, and End-of-Day Reports

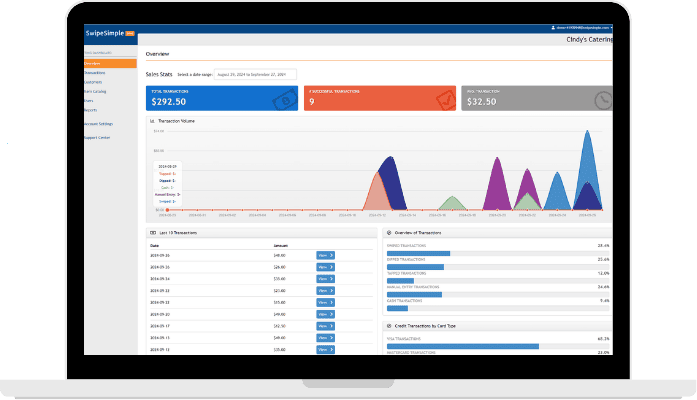

Basic terminals are designed to process payments—period. If you’re logging sales by hand, reconciling tips at the end of each day, or relying on guesswork for inventory, it’s a sign you’ve outgrown your machine.

Real-world examples:

A hair salon owner prints receipts and manually enters tip amounts into a spreadsheet every night.

A mechanic forgets to reorder brake pads because inventory isn’t tracked in real time.

A restaurant staff member has to text a manager the totals from the end-of-day batch report—every single night.

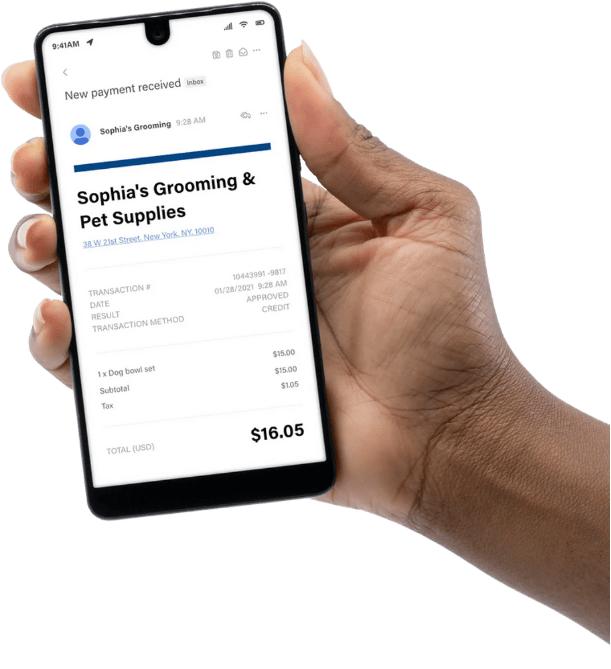

What modern systems can do:

Integrated point of sale (POS) systems, like those available from providers offering Clover, Valor POS, or Figure POS, go far beyond just payments. They can:

Track and adjust inventory in real time

Assign tips per staff member

Provide digital receipts via email or text

Integrate with bookkeeping software and CRMs

Offer itemized reporting by day, employee, or product

Some POS platforms even include scheduling, customer loyalty tools, and marketing features, all accessible from the same dashboard. For retail and restaurant businesses in particular, this kind of system can eliminate hours of admin each week.

3. You’re Absorbing Card Processing Fees—and Losing Margin

If you’re still absorbing the cost of every credit or debit transaction, you’re not alone. Processing fees can add up quickly, especially as more customers choose cards over cash.

Let’s say you pay an average of 3% per transaction. On $25,000 in monthly card sales, that’s $750 going straight to fees—every month. Over a year, that’s $9,000 in lost margin.

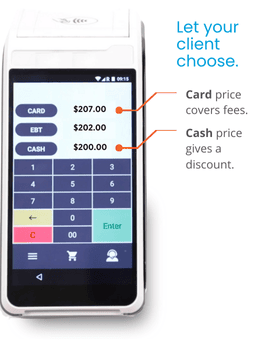

Many businesses are now exploring dual pricing—a model that offers two prices: one for cash and one for cards. It allows businesses to legally and transparently pass on the processing cost to the cardholder while still offering a discount to customers who pay with cash or check.

What’s the catch?

Compliance. States have specific rules about how prices are disclosed, how receipts are printed, and how pricing is communicated at the point of sale.Why older terminals fall short:

Basic credit card machines often can’t:Display both cash and card pricing

Show price breakdowns on receipts

Prompt customers to choose a payment method with clear cost distinctions

What modern systems offer:

Payment solutions designed with dual pricing support—such as Valor’s dynamic receipt display or Dejavoo’s compliant card prompts—are built to handle these requirements out of the box. Some systems also generate shelf tags, signage, and online pricing displays automatically, so the business stays compliant and customers stay informed.

So, What’s the Next Step?

Upgrading your payment solution doesn’t mean turning your whole business upside down. In fact, most modern systems are designed to integrate seamlessly with how you already work—just with more speed, flexibility, and insight.

If you recognized yourself in any of the scenarios above, here are a few questions to help guide your next move:

Do you need to take payments in more than one location?

Are you spending time on manual tasks that software could automate?

Are you looking for a way to stop absorbing the cost of card payments?

If you answered yes to any of the above, it's probably time to explore what’s out there.

Whether it’s a mobile card reader, a wireless Android terminal, or a fully integrated POS, modern tools can help you save time, reduce costs, and deliver a better experience for your customers. The best part? You don’t have to be a tech expert to make the switch. Many solutions are plug-and-play and come with training and support to make onboarding easy.

Growth doesn’t always look like a bigger building or more employees

—sometimes, it’s just about working smarter. And working smarter often starts with upgrading the tools that run your day-to-day. Don’t let outdated payment technology slow your business down. If your current credit card terminal is stuck in the past, it might be time to consider something that’s built for today—and ready for tomorrow.

Not sure where to start? Contact PayLo Pro today. Our team can walk you through modern, compliant payment solutions that fit your business—whether you're looking for a mobile terminal, full POS system, or dual pricing tools that protect your margin. Let’s find the right fit so you can keep more of what you earn.